2025 will be here before you know it, so we’re covering the key marketing trends you need to know about to stay ahead of the competition. If you haven’t checked out part 1, we covered several seismic changes affecting the marketing landscape. From the rise of LinkedIn as the new hot platform to the potential banning of TikTok and the continued evolution of X (formerly known as Twitter), the next year is shaping up to be a very interesting one indeed. That’s not even mentioning how GenAI has completely upended the industry (and the larger world) and will continue to do so. In part 2, we’ll talk about the momentum of CTV in an increasingly cord-cutting world, new search methodologies, nano-influencers, and the growing awareness around data privacy.

Continuous Growth of CTV

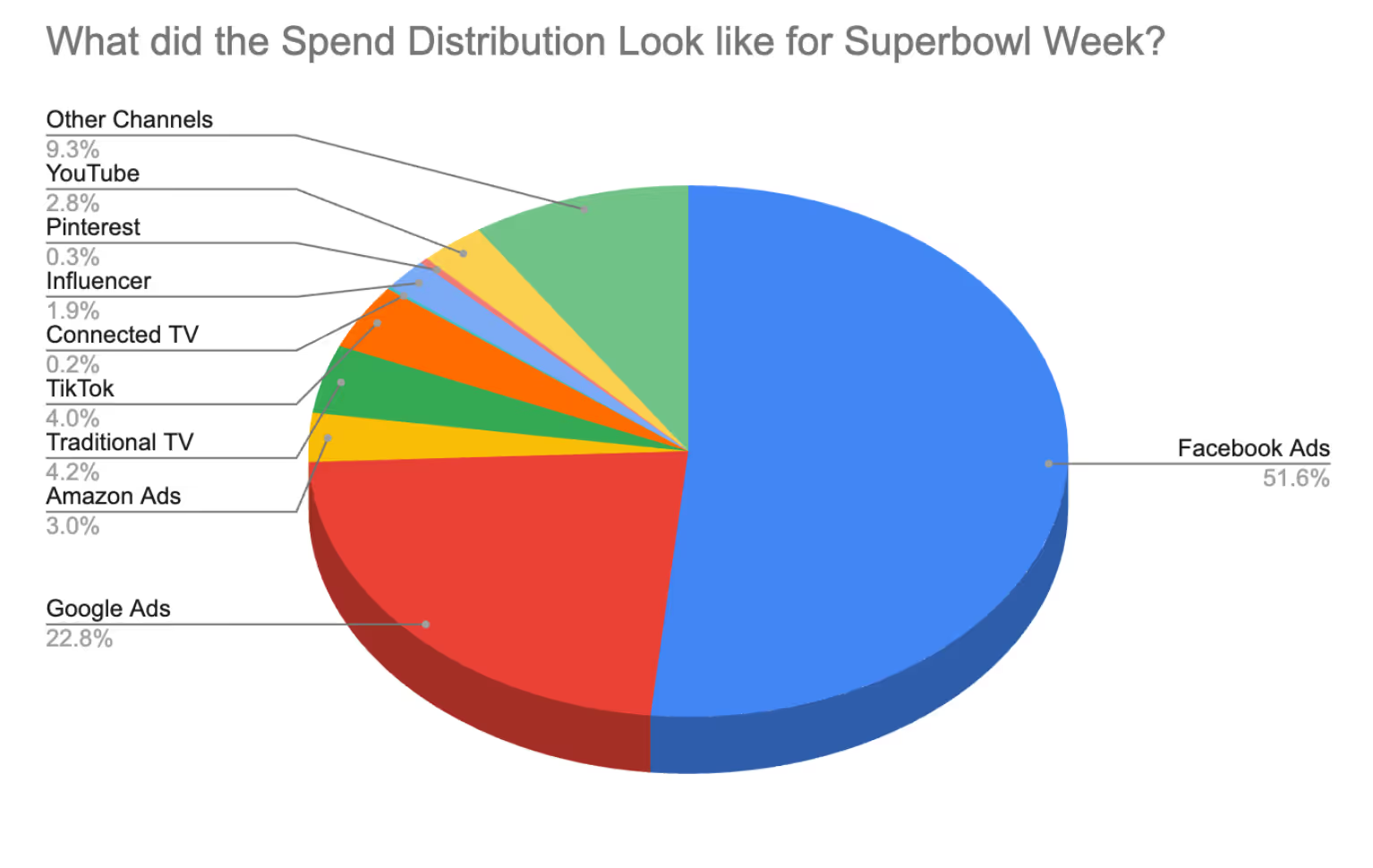

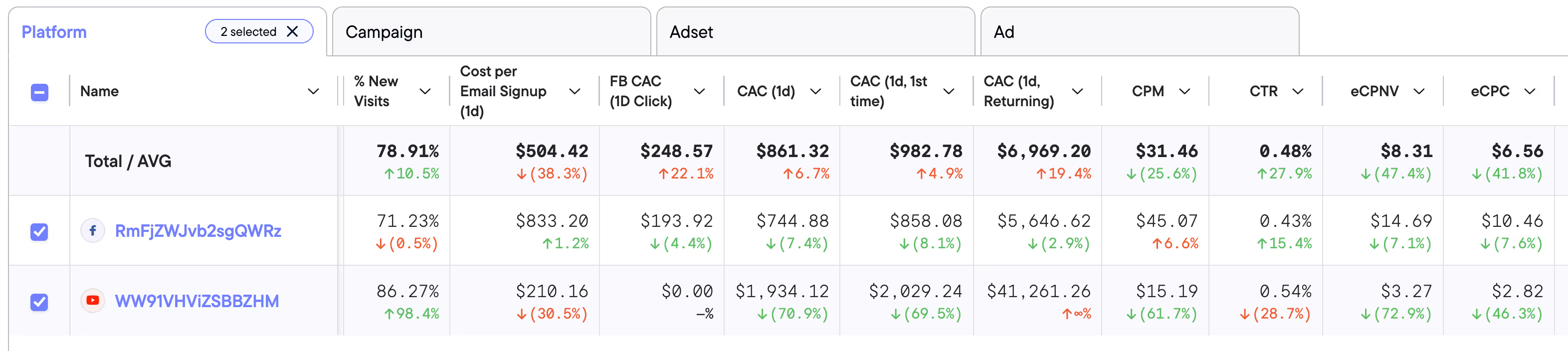

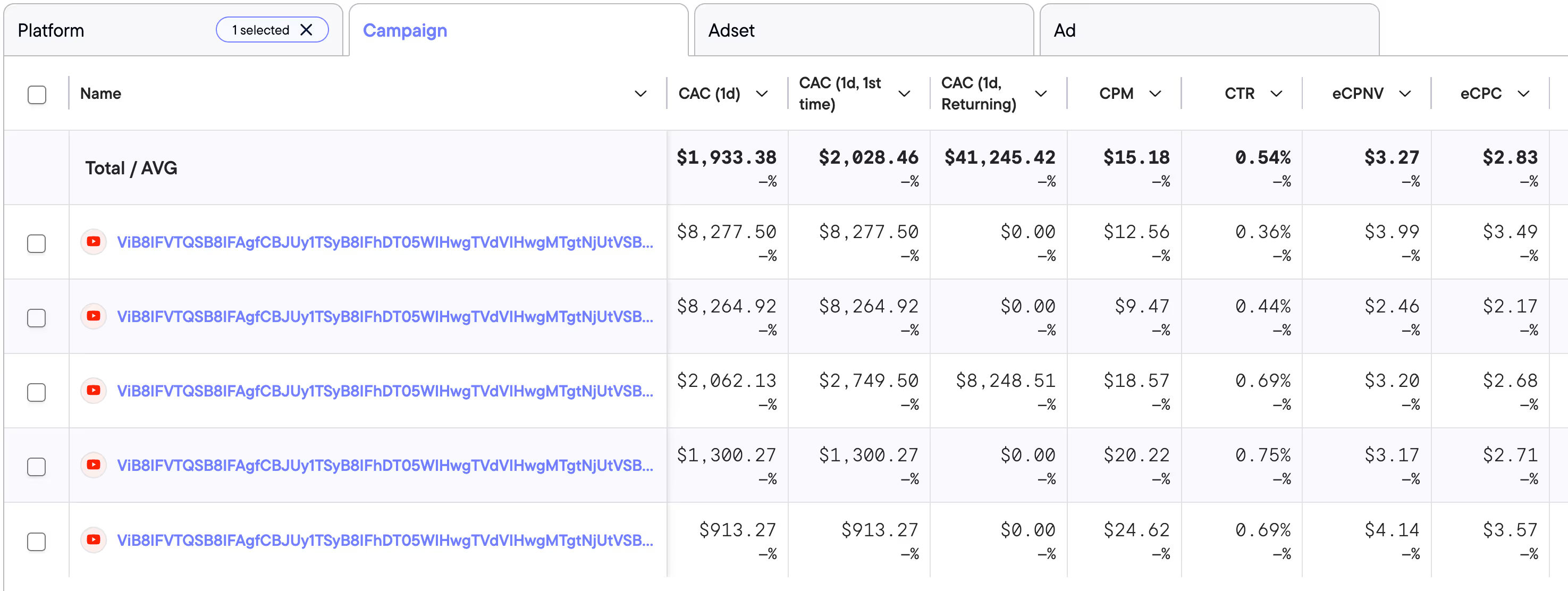

In our modern digital world, Connected TV (ads shown on internet-connected TVs including smart TVs, external devices such as Amazon Fire sticks, gaming consoles, and even traditional TV offshoots like YouTube TV and Hulu with Live TV) has emerged as one of the most effective channels available to marketers. Even though the major social media platforms get most of the shine in digital marketing, CTV is one of the fastest-growing major ad channels in the US: projected to reach roughly $30 billion in 2024, a 22.4% growth from the previous year. That’s almost a third of all TV ad spending as cord-cutting becomes even more mainstream, especially among the younger Gen Z demographic. Linear TV viewership among Gen Z declines by a couple of million people a year, falling below 40 million viewers in 2024. On the other hand, there are 55 million Gen Z CTV viewers and counting. In fact, CTV ad spend is growing faster than the rate at which linear TV ad spend is declining. At some point towards the end of this decade, CTV will likely surpass linear TV altogether. Linear TV is still king for major live events such as the Super Bowl, Olympics, World Cup, etc., but even most of these are now available via CTV (albeit fractured across disparate streamers). This is driven by the fact that people in other generations are also choosing to spend more time watching CTV with their media consumption habits. In 2024, US adults spent 123 minutes per day watching CTV which lagged only mobile devices (235 minutes per day) in usage. CTV ad spend is forecasted to grow double digits through the end of 2027 and already accounts for 10% of ad dollars spent on digital formats.

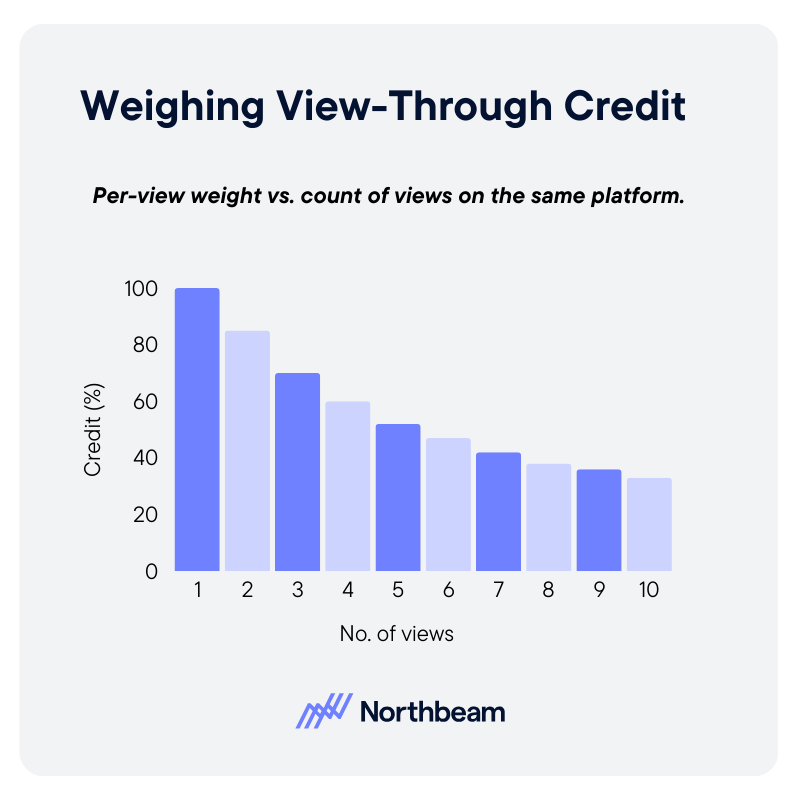

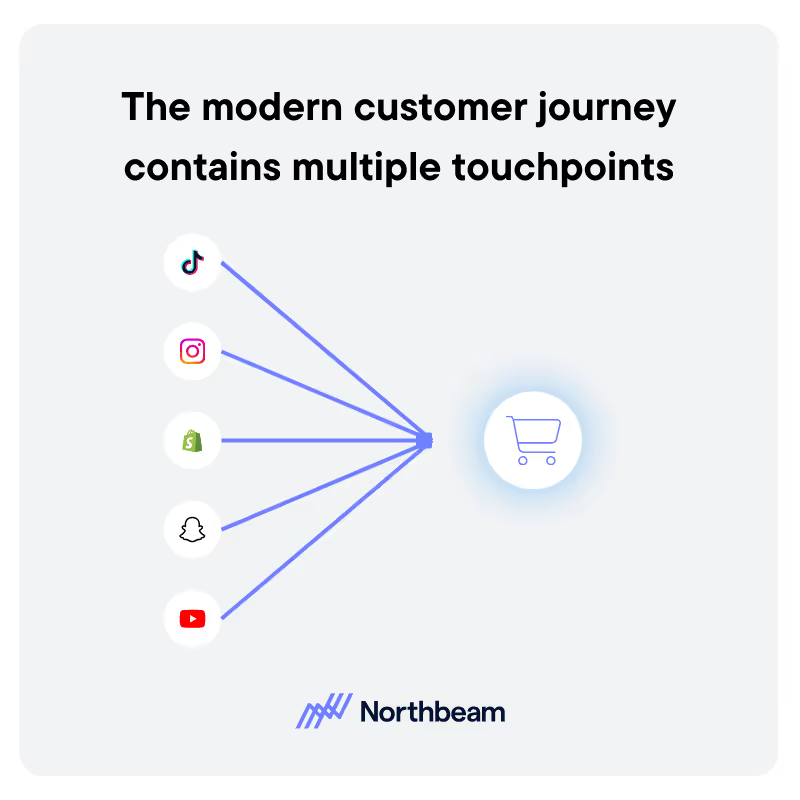

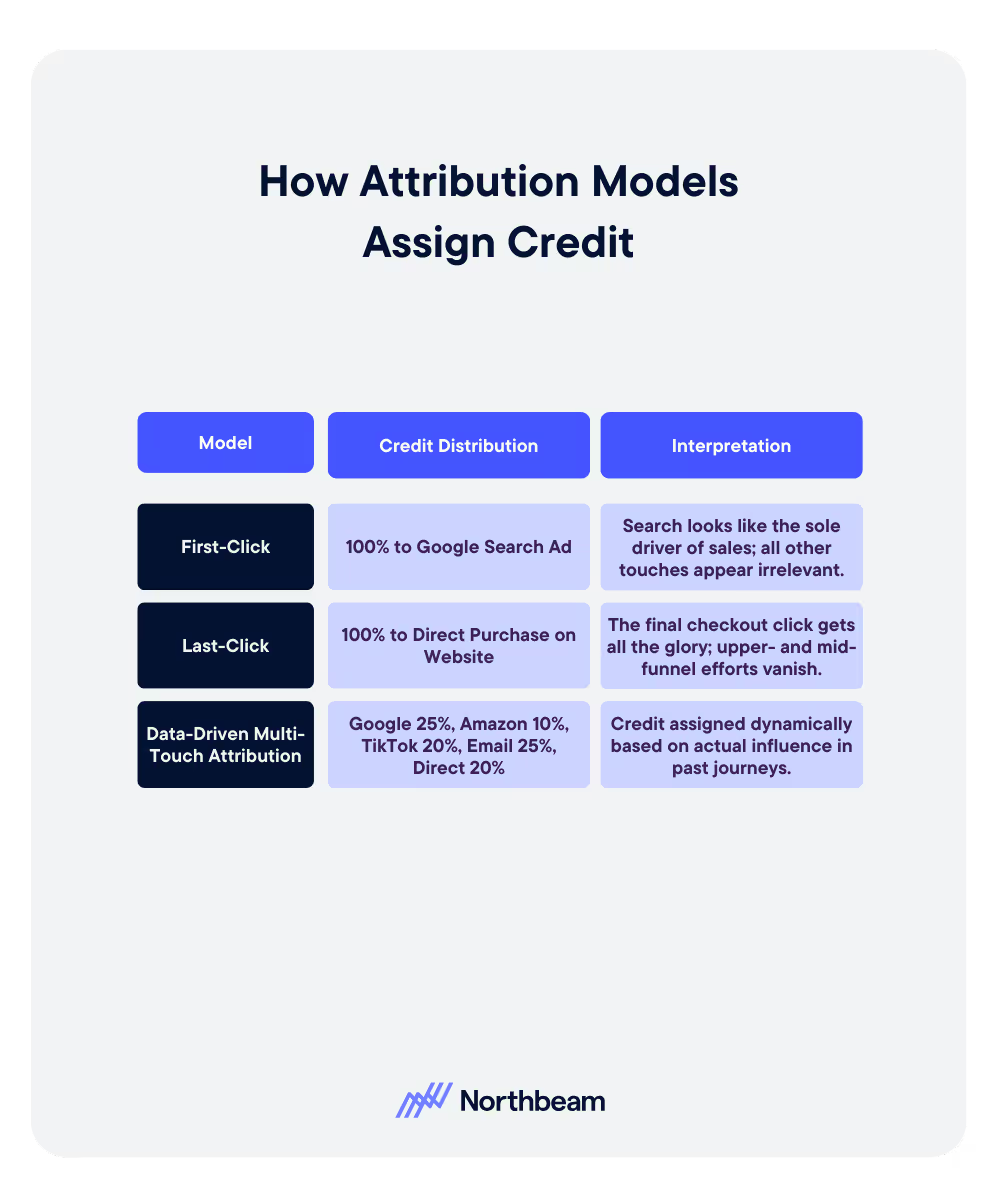

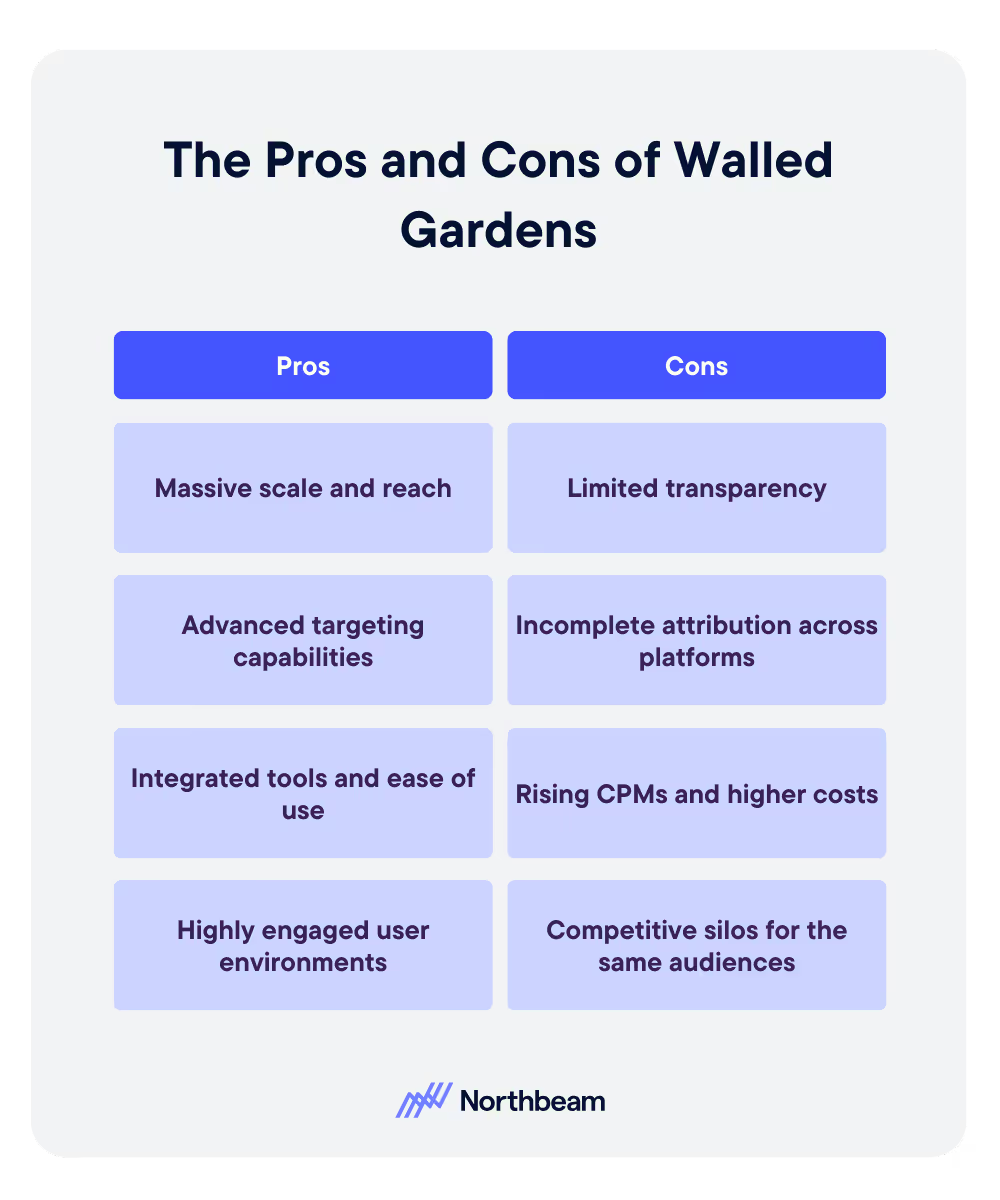

Although CTV has “TV” in its name, CTV acts more like other digital channels such as social media rather than linear TV. CTV allows for precise segmentation and targeting based on interests, demographics, and viewing habits. Streamers have leveraged partnerships with retail media networks and other data brokers to get more accurate reporting and better attribution. CTV lets advertisers analyze trends in real time to aid in campaign optimization just like other performance channels. This is a distinct advantage over linear because we can track a consumer’s journey from first impression to purchase. Note that because streamers often exist as their own distinct walled gardens, advanced techniques such as multi-touch attribution are often needed to track a campaign’s performance across different networks. Last but not least, advertisers have a selection of innovative ad formats including shoppable ads that are more aimed at the bottom of the funnel rather than awareness. These also include formats not available in other channels such as overlays and less intrusive ads.

There are several players in CTV to keep an eye on, but Hulu is the biggest one in the US with $3.8 billion in projected ad revenues in 2024. The company was a first mover in building out an ad tier and live TV offering, so Hulu beat a lot of competitors to the punch when pitching for ad dollars. YouTube comes in second with $3.3 billion and has been aggressively building out its CTV infrastructure to grow that side of its ad business. Amazon has a few CTV products, including Fire Sticks, Fire TVs, Prime Video, and Freevee but is still very much a newer player that’s learning the ropes. Disney+ was able to leverage some of Hulu’s expertise as its corporate owner, but along with Netflix and Max, are still trying to find their footing in the ad-supported game. Notably, Apple TV+ doesn’t yet have a CTV offering, but this may change as the company invests more in digital advertising capabilities.

Newer Forms of Search

It’s no longer enough to have an SEO strategy in place for traditional search; in recent years voice and social search have emerged as popular alternatives to typing keywords into a search query to get answers. According to PwC, 65% of 25-49-year-olds speak to their voice-enabled devices at least once per day. Although voice-enabled search has been around for some time, recent breakthroughs and the wide adoption of smart speakers have accelerated this trend. In 2023, there were an estimated 200 million plus smart speakers in the U.S. Most smartphones, smart TVs, and an increasing number of connected devices feature voice search. In addition to the long runway of potential users, voice search is often faster and more convenient than typing into a search bar. Voice search is a critical opportunity to capture more organic search traffic, especially among this tech-savvy cohort of users who rely on smartphones and smart speakers to look for products and services. It’s important to note that while the foundational SEO strategies remain the same, voice search queries tend to be more conversational and closer to how we speak in real life. A text search might be phrased as “tacos near me” whereas a voice search might be something like “Where can I get the best tacos near me?” Voice search tends to shift focus toward the intent of the searcher as opposed to simply emphasizing keywords. Search engines also reward websites that optimize for voice searches, so investing in this channel can have positive effects on overall SEO and your site’s ranking.

Speaking of new forms of search, younger generations are turning to social media platforms for discovery as opposed to traditional search engines. Instagram is the top search engine for Gen Z with 67% of surveyed users claiming it as their first choice. TikTok was a close second with 62% and Google came in third with 61%. However, these numbers include YouTube, Google Maps, and Google Images which contribute a healthy amount of search traffic to Google, meaning Google Search is now a distant third for Gen Z. If we were to include Gen Alpha, these numbers would probably skew even heavier towards the social platforms. Although we don’t have official numbers, Google disclosed in 2022 that roughly 40% of youth use TikTok or Instagram to search for things like lunch spots rather than Google. Let’s be clear, we’re not saying this is the death of search engines like Google and Bing, but social media platforms are rising in the ranks as search tools across all demographic groups according to SOCI. This isn’t surprising since social platforms rely on algorithms to serve relevant content to users, so they’re naturally set up to be good search engines. Beyond personalization, social platforms tend to have more UGC and authentic content as opposed to Google results served to you by PPC ads. We expect to see this trend continue as younger generations (and even older ones) who grew up with social media increasingly rely on it for search.

Nano-Influencers: Small but Mighty

We’re not exactly sure when influencer marketing truly began, but the practice of companies using prominent figures and celebrities to endorse their products can be traced back to the late 19th century. Once social media gained traction in the early 2010s, the modern influencer was born on platforms such as Facebook, Instagram, YouTube, and now TikTok. Today, they’ve become an integral part of our digital marketing ecosystem because brands want to leverage the communities and audiences those influencers have cultivated. We can loosely define influencers into a few categories:

- Mega-influencers: influencers with over 1M followers, usually made up of celebrities, athletes, actors, rising stars, and other prominent public figures.

- Macro-influencers usually have between 100K and 1M followers

- Micro-influencers then are between 10K and 100K followers

- Nano-influencers have the smallest audience, with somewhere between 1K and 10K followers.

Nano-influencers are a somewhat new addition to the influencer marketing world as their audiences have traditionally been seen as too small to make a difference. Many of us operate under the false assumption that the biggest names will be the most effective at promoting brands, but if we think about our own day-to-day purchase decisions, we’re often influenced by much smaller niche voices who are either part of our community or an expert that we found through research. These figures, with their smaller followings, are often seen as more trustworthy and relatable than the larger influencers who aren’t as approachable to the average consumer. This is because nano-influencers tend to be ordinary digital creators who have a knack for social media and have amassed a small audience along the way. Their followers consider them almost as peers because nano-influencers are highly authentic, presenting honest views of their lives as opposed to the high production value and glossy content from bigger influencers. The biggest benefit of working with nano-influencers is that they have a much higher engagement level than the other categories of influencers. This is because they have more time to respond and interact with their audience and develop meaningful connections. Nano-influencers generally inhabit a specific niche and have a deep understanding of their followers’ interests and preferences. This means they’re very skilled at creating highly specialized content that resonates deeply with their followers. This combination of high engagement rates and loyal audiences who trust the nano-influencer's recommendations translates into higher conversion rates when they endorse a product or service. Last, but not least, nano-influencers tend to be at the very beginning of their journey so they will be much more cost-effective to work with than bigger creators. Thanks to this lower cost, it’s much easier to get positive ROI on your nano-influencer campaigns without even taking into account the higher conversion rates. Partnering with these creators while they’re still up-and-coming allows for the brand and influencer to grow together and organically, even if they may require more coaching and mentoring upfront to get quality content. According to an internal survey conducted by influencer marketing agency Aspire, 70% of brands are already working with smaller creators. We expect to see this trend continue into the holiday season and beyond.

Data Privacy

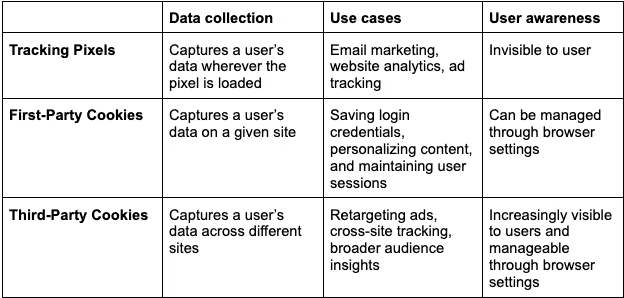

Five years ago, data privacy was generally considered an afterthought; something your legal team dealt with that wasn’t on the forefront of our minds. Today, that’s changed dramatically as data privacy has become a priority for regulators, consumers, and businesses. Privacy laws such as the EU’s GDPR and California’s CCPA regulations spurred a chain reaction of other countries and US states passing their own laws. Examples include Brazil’s General Law for Data Protection, Egypt’s Law No. 151, and Canada’s Digital Charter Implementation Act. As of May 2024, 17 US states have passed data privacy regulations, with several more expected to join them. It’s clear the legislative pace will only pick up, but we’ve also seen regulators take a stronger stance on enforcement actions. In 2023, companies were fined over 2 billion euros for violations of the GDPR (more than the past 3 years combined). Large tech companies including Meta, TikTok, and X (formerly Twitter) have been fined over $3 billion since the passing of GDPR. In the US, the FTC is currently investigating several companies over their use of sensitive data, including geo-location, health, and children’s privacy. One of the most notable cases involves Kochava, a geolocation data broker that the FTC alleges has been selling data that can be used to trace the movements of individuals to and from sensitive locations such as health clinics, shelters, addiction recovery centers, etc. Depending on the outcome of this case, the use of geolocation data may be severely restricted going forward for targeting purposes.

Another regulatory area to keep an eye on is the development of AI policy by governments worldwide. After ChatGPT exploded in popularity, governments became wary about the need for large amounts of training data to train AI models which could infringe on data privacy. Italy temporarily banned ChatGPT in March 2023 because OpenAI was using personal data to train the model without asking for consent (including children’s data because there weren’t age verification tools implemented at that point). OpenAI did create a form for European users to opt out of their personal data being used to train the model and created an age verification tool, but this did little to assuage the EU’s concerns about data privacy. The European Data Protection Board created a ChatGPT task force to develop suitable AI regulations, with several other countries including the US, UK, and China drafting their own guidelines.

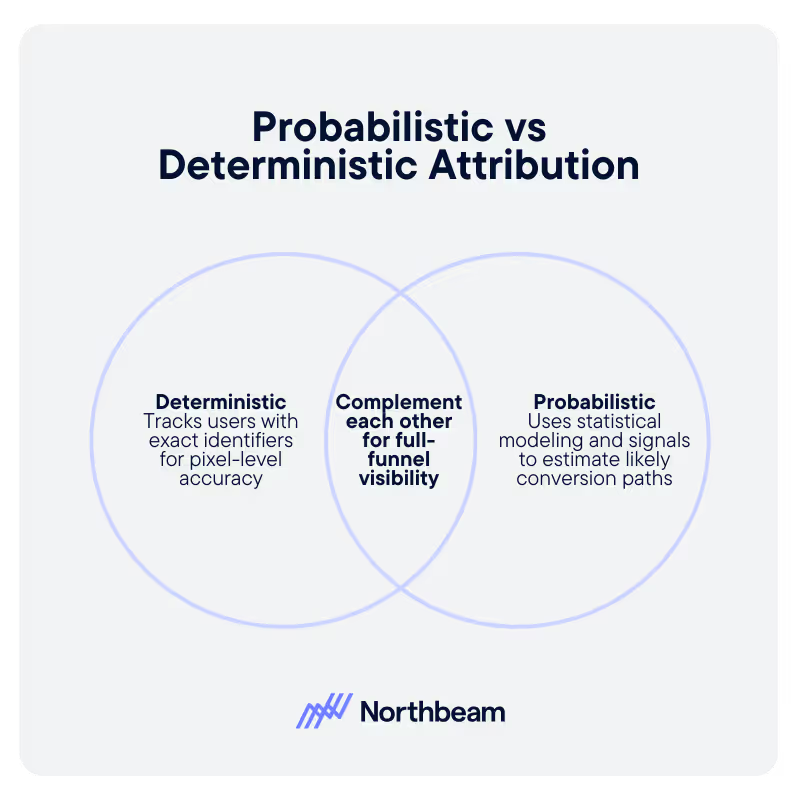

In late 2023, Google claimed that its plan to completely deprecate third-party cookies was on track for the second half of 2024. However, in April 2024 the company announced that they would be further delaying the sunset of third-party cookies until some time in 2025 (although the exact timing is yet to be determined). Why? The company acknowledged that regulators (especially the UK’s Competition and Markets Authority) and advertisers still had key concerns about the implications of removing cookies. The CMA is concerned that transitioning to the Privacy Sandbox will only strengthen Google’s position at the expense of its competitors. At the same time, agencies and marketers can rest a little easier knowing they have more time to figure out a plan to replace third-party cookies in their strategies. We won’t be holding our breath on when Google will actually phase out cookies, but expect the company to figure out a way to launch Privacy Sandbox with the blessing of regulators. Google still expects to complete this in 2025, but would anyone be surprised at all if they kept delaying it for a few more years? Only time will tell!

.avif)

.avif)

%25201.avif)

.avif)

.avif)

.avif)

.avif)

.svg)